Contents

A Sole Proprietorship in China refers to a small-scale business operated by a natural person, where the owner assumes unlimited liability for the business’s debts. This business entity differs from a Limited liability Company (LLC) as it does not have legal person status, meaning the individual and the industry are not legally separate. In formal business or legal documents, “Sole Proprietorship” or “Individual Industrial and Commercial Household” are the most accurate translations. Particularly in the context of official Chinese business registration, “Individual Industrial and Commercial Household” better reflects the characteristics of China’s legal framework. This article explains Sole Proprietorship in China, why foreigners cannot register for one, and how it differs from a limited company.

I. Why Can’t Foreigners Register a Sole Proprietorship in China?

In China, Sole Proprietorship / Individual Industrial and Commercial Household can only be registered by Chinese citizens, meaning foreigners are not eligible. This restriction is primarily based on legal, regulatory, tax, and socio-economic management considerations. Below are the specific reasons:

1. Legal Restrictions

According to the Regulations on Sole Proprietorships and the Company Law of China, only Chinese citizens can apply for a sole proprietorship, while foreigners, foreign-invested enterprises, and residents from Hong Kong, Macau, and Taiwan do not qualify.

Relevant Legal Basis:

- Regulations on Sole Proprietorships (2011 Revision), Article 2 states:”A Sole Proprietorship refers to a natural person engaged in industrial and commercial business activities within the scope permitted by law, and registered with the market regulatory authority.”This clearly stipulates that only Chinese citizens can register a sole proprietorship. Foreigners are not classified as “citizens” under this regulation, so they are not eligible.

- Foreign Investment Law (Effective in 2020) mandates that foreign investment in China must be conducted through a wholly foreign-owned enterprise (WFOE) or a joint venture (JV), rather than through a sole proprietorship.

2. Regulatory and Management Difficulties

A sole proprietorship is personally operated, and its finances and legal responsibilities are not separate from the owner. The taxation and financial reporting requirements are relatively lax, making it more suitable for managing Chinese citizens rather than foreign investors.

Tax Management

Sole proprietorships are subject to fixed-amount tax assessment or small-scale taxpayer taxation, and the government conducts relatively loose financial audits. If foreigners were allowed to register, tax oversight would become more complex, potentially increasing the risks of tax evasion or money laundering.

Business Activity Tracking

Sole proprietorships do not require detailed financial audits, making it difficult for regulatory authorities to verify whether a foreigner is genuinely conducting business in China or merely using the registration for other purposes, such as visa applications or financial transactions.

3. Business Structures Available to Foreigners

Although foreigners cannot register a sole proprietorship, they may legally establish a company in China through the following structures:

- Wholly Foreign-Owned Enterprise (WFOE): Suitable for industries such as trade, consulting, technology, and manufacturing. Requires registered capital and strict financial management.

- Joint Venture (JV): Suitable for industries that require local Chinese partners, such as education and healthcare. Established through a partnership between a foreign investor and a Chinese company.

- Representative Office (RO): Used only for market research and promotion, not allowed to engage in profit-generating activities.

II. Differences Between Sole Proprietorship and Limited Liability Companies in China

In China, sole proprietorship and limited liability company (LLC) are two common business entities, but they differ significantly in legal status, organizational structure, liability, and taxation. Below is a detailed comparison:

1. Legal Status: Sole Proprietorship vs. Legal Entity

| Category | Sole Proprietorship | Limited Liability Company (LLC) |

|---|---|---|

| Legal Person Status | No legal entity status | Recognized as a legal entity |

| Legal Subject | Owner personally responsible | The company is legally independent |

| Business Liability | Owner assumes full responsibility | Company assumes responsibility; shareholders have limited liability |

2. Liability: Unlimited vs. Limited

| Category | Sole Proprietorship | Limited Liability Company (LLC) |

|---|---|---|

| Debt Responsibility | Owner assumes unlimited liability | Shareholders assume limited liability |

| Personal Asset Risk | Owner’s personal assets may be at risk | Shareholders’ personal assets are generally protected |

3. Organizational Structure: Individual vs. Multi-Level Management

| Category | Sole Proprietorship | Limited Liability Company (LLC) |

|---|---|---|

| Management Model | Owner operates independently, no board of directors | Requires a board of directors, shareholders’ meetings, and other governance structures |

| Business Scale | Suitable for small-scale businesses | Suitable for expanding businesses |

4. Registration & Management: Simple vs. Complex

| Category | Sole Proprietorship | Limited Liability Company (LLC) |

|---|---|---|

| Registration Process | Simple (1-3 days) | More complex (3-7 days) |

| Registered Capital | No minimum requirement | Capital registration required (can be pledged) |

5. Taxation & Financial Management

| Category | Sole Proprietorship | Limited Liability Company (LLC) |

|---|---|---|

| Tax System | Personal Income Tax | Corporate Income Tax (25%) + Shareholder Dividend Tax |

| Accounting Management | Simple bookkeeping | Must comply with strict financial reporting and audits |

6. Business Suitability

| Category | Common Business Types |

|---|---|

| Sole Proprietorship | Small restaurants, convenience stores, food delivery workers, repair shops, household services, and other small-scale businesses |

| Limited Liability Company (LLC) | Technology firms, manufacturing, cross-border e-commerce, foreign trade companies, consulting firms, and franchise businesses |

III. Legal and Contractual Considerations for Sole Proprietorships in China

In China, a Sole Proprietorship refers to a small business entity registered by an individual. Only Chinese nationals can apply for and register a Sole Proprietorship. Unlike a Limited Liability Company (LLC), a Sole Proprietorship does not have a separate legal personality, and the owner assumes unlimited personal liability for the business’s debts and obligations.

A key distinction between a Sole Proprietorship and an LLC lies in their legal status and ownership structure:

- A Sole Proprietorship does not have a legal representative. Instead, it is managed by an operator or owner, who is fully responsible for the business.

- There is no board of directors or supervisor in a Sole Proprietorship, as it is entirely controlled by the individual owner.

- In contrast, an LLC has independent legal status, and its shareholders only bear limited liability up to the amount of their capital contributions.

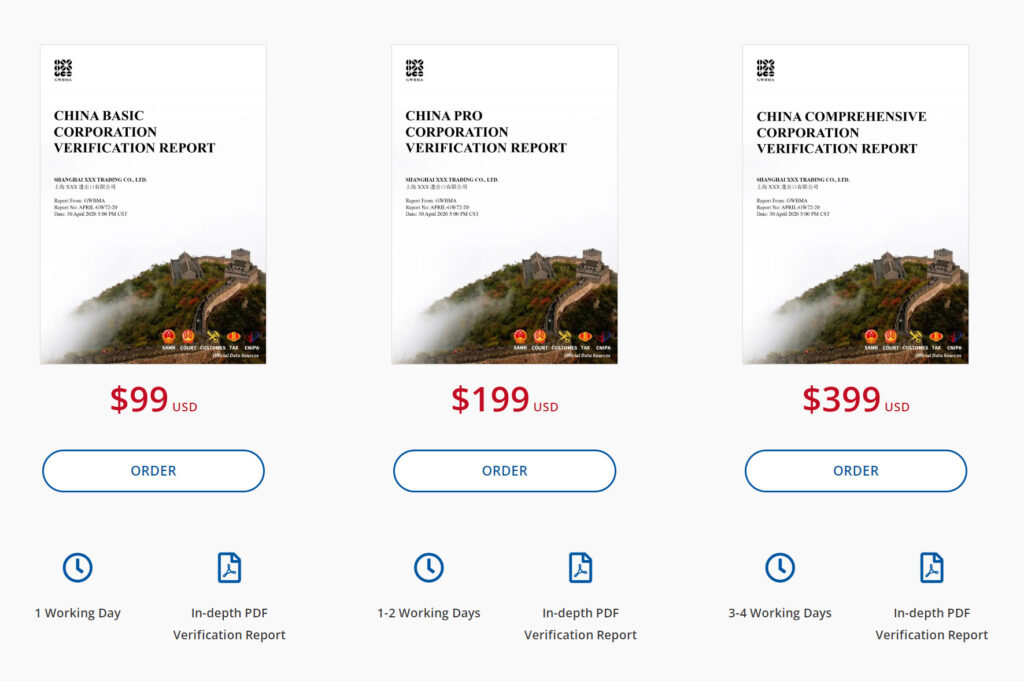

When verifying the exact legal nature of a Chinese target company, it is essential to use a GWBMA Manual Company Verification Report to confirm whether the entity is a Sole Proprietorship or an LLC. This is particularly important when signing a contract.

From a contractual perspective, if the counterparty is a Sole Proprietorship, the risk exposure is theoretically unlimited, as the owner is personally liable for all business obligations. This means that any legal claims or debts incurred by the Sole Proprietorship directly affect the owner’s personal assets, unlike an LLC, where liability is limited to the company’s registered capital.

Conclusion

China’s sole proprietorship is suitable for small-scale, low-risk businesses. It has low startup and operational costs but requires the owner to assume unlimited liability. Limited liability companies, on the other hand, are better suited for larger-scale businesses that require clearly defined shareholder responsibilities and corporate governance structures. While they involve higher registration and operational costs, they offer limited liability protection, making them a safer choice for expanding enterprises.