Contents

Introduction:

A Shell company in China usually refers to those companies that, in terms of name and registered capital, appear to have the characteristics of a real enterprise but in reality, do not engage in any actual business activities or employ staff. In recent years, as the corporate registration system has steadily improved and market competition has intensified, many companies have sought to create an image of formidable strength by establishing high registered capital and adopting company names that exude an industrial feel. This approach is often used to attract investment, meet regulatory requirements, or facilitate internal capital operations. In fact, although the figures on paper may be impressive, a closer investigation often reveals that these companies lack normal business operations and genuine employment records. This article explores the true nature of Shell Company in China, highlighting its impact on risk assessment, market oversight, and corporate governance, providing essential insights for investors, regulators, and market participants.

The Differences Between the Form and Substance of Shell Company in China

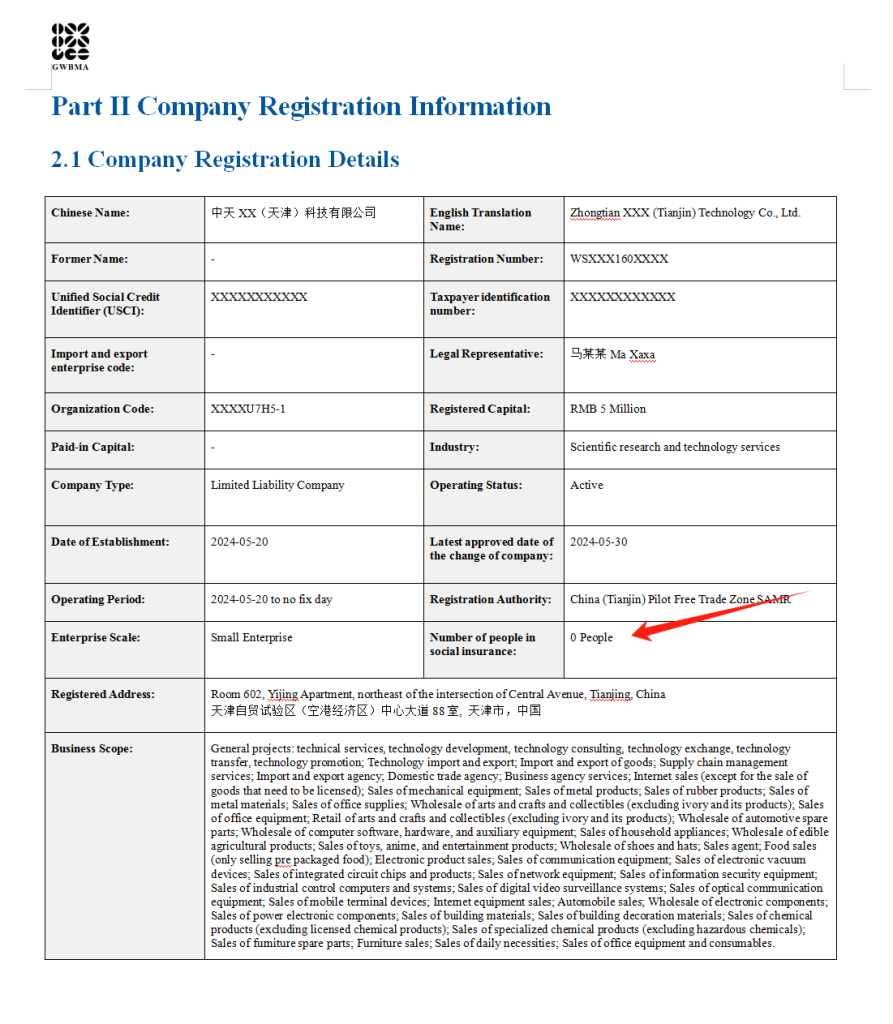

Shell companies in China often appear to be legitimate corporations—with strong names and large registered capital—but they do not engage in actual business operations or employ staff. Over time, companies have used this strategy to attract investments or meet regulations, but a deeper look reveals that they often lack real operations or employee records. Understanding the true nature of these companies is crucial for investors and regulators. Many companies set high registered capital (for example, 5 million RMB) and adopt names that give off an industrial impression, which makes outsiders immediately assume that they possess considerable strength.

However, as shown by third-party verification reports such as the China Corporation Verification report, if a company is found to have no insured employees, it generally indicates that it has not engaged in normal business operations. For companies that are truly operating, employing staff and paying social insurance contributions are indispensable markers of genuine business activity.

Shell Company in China: The Key Role of Shareholder Structure

Some companies use high registered capital and industrial-sounding names to attract investors and satisfy various commercial qualification requirements, even though they do not have the corresponding actual business or production capabilities.

To save on expenses such as social insurance and other personnel costs, some companies deliberately maintain a shell status, thereby avoiding the inevitable expenditures that come with actual operations. Shell companies are sometimes employed as vehicles for corporate restructuring, asset transfers, or even money laundering, essentially serving only as a “container” rather than engaging directly in day-to-day business activities.

- Focus on Shareholder Background: Relying solely on a single company’s social insurance data (for example, having zero insured employees) is not enough to fully assess its substance. For instance, even if a company itself does not employ any personnel, if its major shareholders include several robust companies with hundreds or even thousands of insured employees, this reflects the true economic strength of the entire group.

- The Strategic Significance of Corporate Structure: In many corporate groups, the holding company serves mainly as a platform for capital operations, unified management, and strategic coordination rather than directly participating in production or operations. This structure offers advantages in risk isolation, tax planning, and resource integration, but it can also be abused to evade regulatory oversight or information disclosure obligations.

- The Strategic Significance of Corporate Structure: In many enterprise groups, holding companies primarily serve as platforms for capital operations, centralized management, and strategic coordination rather than engaging directly in production or business activities. This structure is commonly used for risk isolation, tax planning, and resource allocation. However, if misused, it can also serve as a means to evade regulations or avoid disclosure obligations.

Shell Company in China: 6 Risks of Zero Social Security Employees

- Investment Risks: Investors who judge a company based solely on its registered capital or company name may misinterpret its actual business condition, potentially overlooking risks related to incomplete information disclosure or misleading marketing.

- Regulatory Challenges: If regulatory authorities rely only on surface-level data while ignoring actual operational indicators—such as social security contributions, employee numbers, and tax records—they may be easily misled by the outward appearance of shell companies.

- Market Integrity and Fairness: The widespread presence of shell companies can disrupt market order, lower the overall creditworthiness of the business environment, and create unfair competition against companies engaged in genuine business operations.

- Enhancing Information Transparency: Strengthening third-party verification mechanisms and making corporate social security contributions, tax records, annual reports, and audit reports publicly accessible can help regulators and investors gain a clearer picture of a company’s real operational status.

- Improving Legal and Regulatory Frameworks: Implementing stricter corporate registration and information disclosure requirements, along with rigorous investigations into fraudulent registrations and illegal activities of shell companies, is essential to ensuring that a company’s “paper strength” aligns with its actual business activities.

- Establishing a Comprehensive Evaluation System: Business evaluations should not rely solely on registered capital and company names. Instead, a multidimensional assessment system—including social security contributions, tax payments, and actual business activities—should be developed to more accurately identify and combat shell companies in China operations.

GWBMA Case Study: Shell Company in China

To illustrate this phenomenon, consider a scenario where a large enterprise group establishes a holding company—Shanghai XYZ Holding Co., Ltd.—for capital operations and risk isolation. This company has a registered capital of 10 million RMB, but in practice, it conducts no production or service activities, and its social security records indicate zero employees, making it appear on the surface to be a shell company in China.

However, upon further investigation, it is revealed that the primary shareholders of Shanghai XYZ Holding Co., Ltd. include:

- Shanghai ABC Manufacturing Co., Ltd. – Employs approximately 500 staff and is engaged in manufacturing.

- Shanghai DEF Trading Group – Employs around 1,500 staff and handles domestic and international trade as well as logistics operations.

Under this structure, Shanghai XYZ Holding Co., Ltd. functions solely as a centralized management and capital operations platform, without directly hiring employees. While this type of corporate structure can facilitate resource integration and risk diversification when used appropriately, it can also be misused to obscure related-party transactions or engage in other non-transparent financial activities.

Conclusion:

The existence of shell companies highlights a disconnect between China’s corporate registration system and actual business operations. Relying solely on a single data indicator—such as the number of insured employees—may obscure the complex shareholder structures and operational models behind certain enterprises. Only through a comprehensive evaluation of factors such as registered capital, company name, shareholder background, social security contributions, tax records, and actual business operations can the true nature of a company be accurately assessed.

Regulators and market participants should focus on enhancing transparency, strengthening legal and regulatory frameworks, and developing a multidimensional assessment system to prevent the misuse of shell companies, while also recognizing the legitimate strategic role of holding companies within a well-structured corporate framework.