Contents

Introduction:

In today’s globalized business landscape, entering the Chinese market is a critical step for many international enterprises. A Representative Office in China is a popular and relatively straightforward method for foreign companies to explore and expand their business activities. Although ROs are not permitted to directly engage in profit-making activities, they play a crucial role in conducting market research, promoting brands, and providing essential support services for their parent companies.

This article aims to provide a comprehensive guide on setting up a Representative Office in China, including the necessary legal procedures, operational steps, and post-establishment management and compliance requirements. We will also explore the advantages and limitations of establishing an RO compared to other business structures such as Wholly Foreign-Owned Enterprises (WFOEs) or Joint Ventures (JVs), and how to make the best decision based on your company’s specific needs. This guide is intended to assist international enterprises planning to establish a footprint in the Chinese market with practical advice and clear instructions.

Definition and Basic Functions of a Representative Office in China

A Representative Office (RO) is a non-profit entity established by foreign companies in mainland China. Its primary functions are to represent its parent company in conducting market research, promoting sales, and engaging in other non-profit business activities. The establishment of ROs has been a traditional method for foreign companies to enter the Chinese market, dating back to the early days of China’s economic reforms when many foreign businesses used ROs to explore the rapidly expanding Chinese market potential.

Legal Status:

In China’s legal framework, an RO does not possess legal person status, which means it cannot directly engage in commercial transactions, sign sales contracts, or handle direct receipt of payments. All its business activities must be strictly confined to non-profit purposes, such as brand promotion, product introduction, market research, and providing technical support. This legal status significantly differentiates an RO from other business entities like a WFOE or a JV, which have legal person status and can engage in commercial activities and profit-making within China.

Basic Functions:

- Market Research: ROs can conduct extensive market studies to help their parent companies understand the latest market trends and consumer demands in China, thereby aiding in effective strategy formulation.

- Business Promotion: Although not allowed to sell directly, ROs can facilitate brand and product promotion through exhibitions and promotional events, laying the groundwork for future sales activities.

Customer Service and Technical Support:

They provide ongoing support and technical services to existing customers, deepening relationships and maintaining the company’s good reputation in the Chinese market.

Communication Bridge:

Serve as a communication link between the parent company and Chinese clients or partners, ensuring accurate information transfer and helping resolve any arising issues.

Through these functions, although ROs face legal restrictions, they effectively support the business development of foreign companies in China. However, for businesses aiming to achieve direct commercial profits in the Chinese market, other forms such as a WFOE or JV might be considered to meet their operational needs and maximize benefits.

Legal Positioning and Regulations for Representative Offices in China

In China, the establishment and operation of ROs are primarily governed by specific laws and regulations:

Regulations on the Administration of Registration of Resident Representative Offices of Foreign Enterprises:

This regulation is the fundamental legal document that governs the activities of ROs established by foreign enterprises in China. It details the procedures for setting up ROs, their operational scope, and supervision mechanisms. According to this regulation, ROs lack legal person status and are not allowed to engage directly in profit-making activities; their functions are limited to conducting market research, promotional activities, and other non-profit functions.

Relevant Sections of the Company Law of the People’s Republic of China:

While the Company Law primarily regulates companies with legal person status, its provisions also indirectly affect ROs, particularly in terms of legal operations and internal management.

Tax and Audit Regulations:

Although ROs cannot engage directly in profit-making activities, they are required to pay taxes on operational expenses incurred in China, such as employee salaries and office rent. Additionally, ROs must conduct necessary financial audits and tax filings according to the Tax Law of the People’s Republic of China.

Foreign Exchange Regulations:

Since ROs may involve cross-border fund transfers, their foreign exchange transactions must comply with the Foreign Exchange Regulations of the People’s Republic of China and related rules set by the State Administration of Foreign Exchange (SAFE).

Labor Regulations:

ROs must comply with the Labor Contract Law of the People’s Republic of China and other relevant labor regulations when employing staff in China, ensuring that the legal rights of employees are respected and protected.

Adhering to these laws and regulations allows ROs to operate legally and stably in China. Although their functions and rights are restricted, they can still significantly contribute to their parent companies’ market expansion efforts in China through legal operations and effective market activities. This section helps foreign enterprises better understand the legal framework they must follow to establish an RO in China, ensuring their activities are legal and effective.

Financial Soundness Certification of Representative Office in China

In the process of setting up an RO in China, demonstrating the company’s financial soundness is a crucial step. This not only showcases the company’s economic strength but also assures its long-term stable operation in China. According to Chinese regulations, foreign companies applying to establish an RO must submit a series of financial documents that detailedly illustrate the company’s financial status and cash flow conditions.

Role of the Financial Audit Report:

A financial audit report, issued by an independent third-party audit institution according to international or home country financial reporting standards, thoroughly records the company’s financial condition, balance sheets, income statements, and cash flow statements. This report is essential in proving that the enterprise has the economic capability to establish an RO in China:

- Demonstrating Economic Strength: The data and analysis in the financial audit report show the company’s financial robustness to Chinese regulatory authorities, proving it can bear the costs of operating in China, including office rent, employee salaries, and daily management expenses.

- Enhancing Credibility: A formal financial audit report enhances the company’s credibility, showing its business transparency and commitment to adhering to international financial standards, which is extremely important in a market like China.

- Risk Assessment: The report also assists Chinese regulatory bodies in assessing the economic risks associated with introducing the foreign enterprise, ensuring its activities do not adversely affect the local market.

Required Financial Documents and Information of ROs in China:

To meet approval requirements, besides the financial audit report, companies may also need to submit the following financial documents:

- Proof of Funds: Such as a bank statement showing the company has sufficient liquid assets.

- Asset Proof: Includes but is not limited to the company’s fixed assets and investment conditions, further verifying the company’s economic foundation.

- Debt and Liability Details: A detailed debt report can help assess the company’s financial health, especially its ability to repay debts.

- Operational History and Profitability: Showcasing the company’s operational results and profitability over the past few years to prove the viability and stability of its business model.

Companies should ensure the accuracy and timeliness of all financial documents to avoid delays or rejections in the approval process. It is advisable for companies to work with professional financial advisors to ensure all documents comply with Chinese legal standards and international norms. Comprehensive and transparent financial preparation not only facilitates smooth approval for setting up the RO but also helps establish a good business image and credibility in the initial stages of entering the Chinese market.

The Process of Establishing a Representative Office in China

Updates on Regulatory Authority:

The regulatory authority for registering ROs in China was formerly known as the Administration for Industry and Commerce (AIC) and has been renamed to the State Administration for Market Regulation (SAMR). This agency is responsible for overseeing and approving the establishment of foreign representative offices, ensuring all business activities comply with national market rules and legal standards.

Detailed Registration Process:

- Application Submission: Businesses need to submit an application for setting up the RO to the local SAMR, including necessary documents such as copies of the parent company’s business license, audit reports, the RO’s business plan, and appointment documents for representatives.

- Name Approval: The first step is to get approval for the RO’s name. The name must include the full name of the company and the phrase “Representative Office”, and must be distinct from other business names.

- Premises Proof: Submitting a lease contract for the RO’s office space, proving it has a suitable workplace.

- Bank Reference Letter: A reference letter from the parent company’s bank is required, confirming its good financial standing.

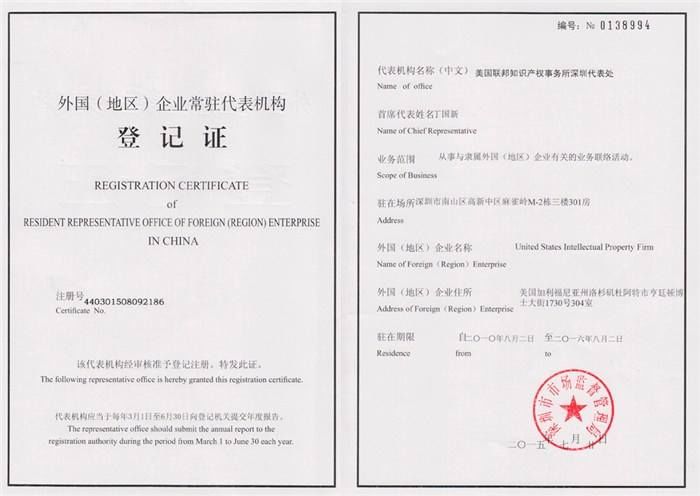

- Registration and Licensing: Once approved, the RO needs to register formally with the local SAMR and obtain the “Registration Certificate of the Foreign Enterprise Permanent Representative Office”, which is the official document proving its legal operation.

- Follow-up Procedures: After registration, the RO must also complete tax registration, statistical registration, and other subsequent procedures, and regularly report its operating status to relevant departments.

Considerations for ROs in China:

- Approval Time and Costs: The entire approval process may take several months, and costs vary depending on the region and required services.

- Compliance Requirements: Since the scope of business and activities of ROs are strictly limited, ensuring all operations comply with Chinese laws and the latest regulations from SAMR is extremely important.

Types of Foreign Companies Unsuitable for Establishing Representative Office

Types of Companies Unsuitable for Representative Office in China:

- Businesses Needing Direct Sales or Production: Since ROs cannot engage directly in sales or production activities, companies primarily involved in these operations are not suitable for setting up an RO. These businesses should consider establishing a WFOE or forming a JV with local companies.

- Enterprises Requiring Direct Revenue and Profit Operations: If a company’s main goal is to generate revenue and profit in China, setting up an RO is not a suitable option. ROs are only permitted to engage in market research, promotional activities, and assisting the parent company’s business, and cannot directly participate in revenue-generating activities.

- Companies with High Cash Flow and Investment Return Requirements: For companies expecting significant investment returns and cash flow in the short term, the establishment of an RO might not meet their business needs. The operational restrictions of an RO could affect the company’s capital efficiency and profitability.

Common Issues and Situations of Representative Office (RO):

- Necessity of Leasing a Physical Office: Unlike a WFOE or JV, which can use a virtual address or centralized registration, an RO must operate from an actual leased office space. This is because the legal positioning of an RO requires it to have a real operational site for necessary supervision and management.

- Compliance Risks: If an RO attempts to operate beyond the legally defined scope of business, such as trying to engage in sales or other profit-making activities, it faces legal risks and potential penalties. This practice violates Chinese regulations concerning foreign representative offices.

- Office Lease Costs: In major cities like Beijing or Shanghai, the cost of leasing high-quality office space can be very high, adding to the initial and operational costs for businesses. For small businesses or startups with limited budgets, this could be a significant financial burden.

How to Process an RO in China: Detailed Procedures and Key Points

Official Name of the Representative Office (RO) in China:

- Official Name: In China, the formal name for a foreign (regional) enterprise permanent representative office is usually referred to as “Foreign (Regional) Enterprise Permanent Representative Office”. When choosing a Chinese name, it should comply with Chinese regulations and accurately reflect the parent company’s brand and identity.

- Name Requirements: The name should include the full name of the parent company and its business nature, plus the phrase “Permanent Representative Office”, to comply with the requirements of the State Administration for Market Regulation (SAMR). For example, if it is the American XYZ Company, the name of its RO could be “American XYZ Company Permanent Representative Office in China”.

Application Process and Key Documents:

- Primary Steps: Initially, businesses need to submit an establishment application to the local Market Regulation Administration, including a detailed business plan and documents proving the company’s legality.

- Company Registration Proof: Legality proof documents from the parent company, typically needing notarization and embassy certification.

- Financial Audit Report: Showcasing the company’s financial status over the past year to prove its economic strength.

- Appointment Documents: Clearly indicating the appointment of the Chief Representative and other representatives of the office.

- Office Location Proof: A lease contract proving a fixed office location.

- Qualifications of the Chief Representative: The Chief Representative is usually a senior management member or someone capable of representing the company in significant business activities.

- Legal Responsibility: The Chief Representative acts as the legal representative of the company in China, responsible for daily operations and legal affairs.

- Review Period: From submitting complete application materials to approval, it usually takes several months. During this period, the relevant departments will review the compliance and completeness of all documents.

- License Issuance: Once approved, the representative office will receive the “Registration Certificate of the Foreign Enterprise Permanent Representative Office”, which is the official document proving its legal operation.

Conclusion:

By thoroughly analyzing these stringent economic entities, GWBMA has provided foreign enterprises with a better understanding of the key factors needed to prepare before establishing a representative office in China, ensuring that everyone can register and operate successfully while complying with all regulations. Additionally, through the above analysis, companies can more accurately determine whether an RO aligns with their business expansion strategies in China and avoid potential compliance issues and economic risks.