Contents

Introduction:

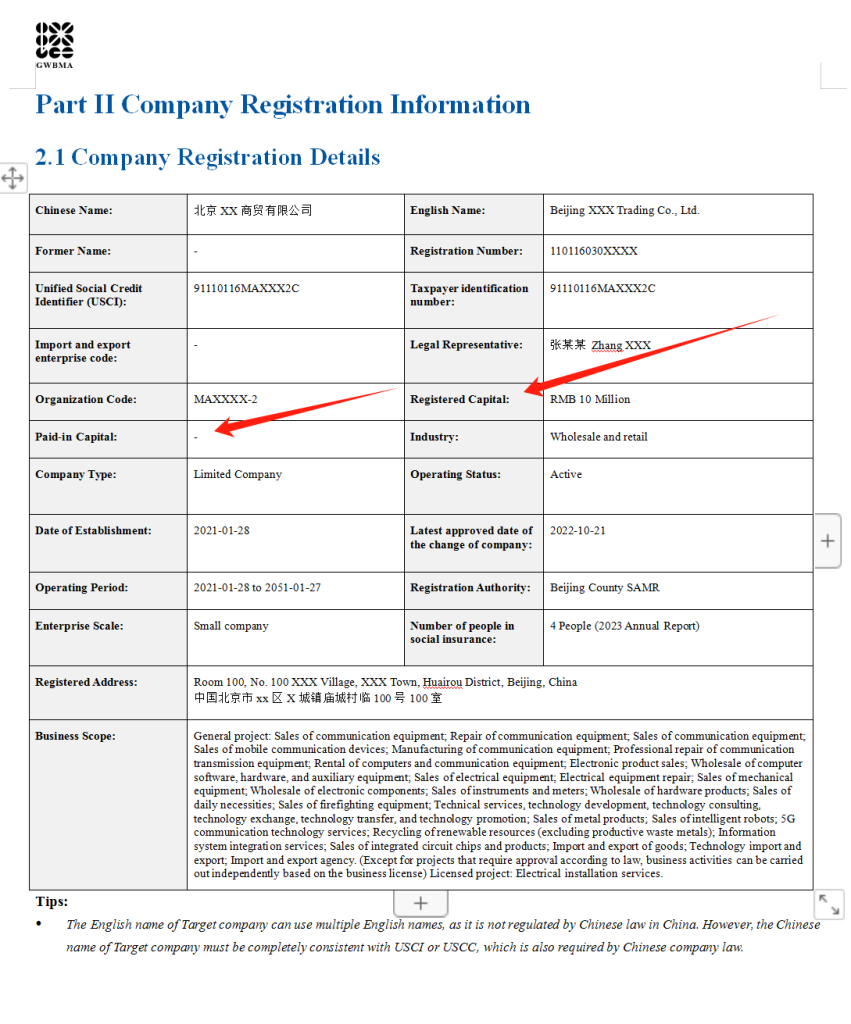

While different from countries like the U.S. and Europe, China’s corporate law and capital structure are uniquely distinct. Understanding the Registered Capital in China and Paid-in Capital of Chinese companies is crucial for ensuring smooth business transactions. I often get questions from my foreign friends asking if they can trust a Chinese company that claims to have a Registered Capital of 10 million RMB. In this article, we aim to provide foreign businesses with a comprehensive guide to understanding these two key concepts and their legal implications when doing business in China.

Why ther is Registered Capital & Paid-in Capital in China?

When dealing with Chinese companies, it is important to recognize the major differences between the corporate legal systems of China and those of countries like the U.S. and Europe, particularly in terms of capital structure. For foreign businesses, Registered Capital is often seen as an indicator of a company’s strength and credibility, but in China, it does not always reflect the company’s actual financial status.

In China, before engaging in business or investment, it is essential to fully grasp the differences between Registered Capital and Paid-in Capital. Simply put, Registered Capital is the amount the company commits to invest when it is established, while Paid-in Capital represents the actual funds invested. These two concepts differ not only legally but also have significant impacts on operational risks and the company’s creditworthiness. Therefore, understanding their differences is key to successful business cooperation.

Differences and Significance of Registered Capital in China and Paid-in Capital

In China, corporate law mandates that every company must declare a Registered Capital, which is the capital amount committed at the time of registration. However, this does not mean the company must inject the full amount of capital immediately. In contrast, Paid-in Capital refers to the actual funds deposited into the company’s account. This difference is especially critical in Chinese corporate law because it directly affects a company’s financial stability and external image.

1. Registered Capital

Registered Capital refers to the total capital a company registers in its articles of incorporation. This figure represents the maximum legal liability the company assumes and is a key indicator of its financial strength. The amount of Registered Capital influences the company’s market credibility and its ability to secure loans and business opportunities.

2. Paid-in Capital

Paid-in Capital is the actual amount of capital contributed by shareholders and deposited into the company’s account. Unlike Registered Capital, Paid-in Capital reflects the company’s real financial strength and forms the foundation for its operations and development. The level of Paid-in Capital directly impacts the company’s financial health and credit rating.

3. Differences Between Registered Capital and Paid-in Capital

- Legal Definition: Registered Capital is the company’s legal commitment to invest, whereas Paid-in Capital is the actual capital provided by shareholders.

- Cash Flow: Registered Capital can be injected over time, while Paid-in Capital must be paid according to the company’s charter.

- Financial Impact: Registered Capital affects the company’s market image and credibility, while Paid-in Capital is crucial for the company’s operational capacity and financial condition.

4. Significance of Registered Capital and Paid-in Capital

- External Presentation: High Registered Capital can enhance the trust of partners and customers, helping the company expand its business.

- Legal Liability: Registered Capital defines the company’s legal liability and protects the interests of creditors.

- Financing Capacity: Sufficient Paid-in Capital helps the company secure loans and attract investors.

- Operational Stability: Adequate Paid-in Capital ensures the company has enough funds for daily operations and unforeseen events.

Legal Analysis of Registered Capital in China Reforms

Understanding the latest revisions to corporate law is crucial when dealing with Chinese companies. The 2023 revision of the Company Law of the People’s Republic of China introduced several new regulations, with the most important being that Registered Capital must be converted into Paid-in Capital within five years. This change has far-reaching implications for company registration and capital management, especially for those companies that opt for high Registered Capital.

1. China’s Registered Capital to Paid-in Capital Conversion Requirement

According to the 2023 revision, all companies must fulfill their capital commitment by converting Registered Capital into Paid-in Capital within five years. In the past, companies could pledge large amounts of Registered Capital without actually depositing the funds immediately. However, this practice is no longer permitted after five years.

Previously, many Chinese companies registered a large sum of capital to project strength. The new law now requires them to complete the corresponding Paid-in Capital contribution within five years. As a result, businesses need to be more cautious when deciding on the size of their Registered Capital to avoid financial pressure in the future.

2. Risks of High Registered Capital

Companies that have registered a large amount of capital but fail to convert it to Paid-in Capital within the five-year period face significant risks. Failure to comply may increase the company’s legal liability and result in penalties. This is particularly important for Wholly Foreign-Owned Enterprises (WFOE) and other foreign businesses entering the Chinese market.

In the past, the time limit for paying Registered Capital was relatively flexible, allowing companies to complete the contribution over an extended period. However, the 2023 reform shortens this period to five years, prompting companies to meet their capital commitments sooner. Non-compliance could lead to fines and negatively affect the company’s credit rating, making it harder to secure loans or attract investments.

3. Impact on Foreign Businesses

Foreign businesses, particularly WFOEs and Joint Ventures (JVs) in China, need to be aware of and comply with this regulation. Many foreign companies may be unfamiliar with China’s Registered Capital laws and opt for an excessively high capital amount, which could cause difficulties in the long run. With the new legal requirements, foreign businesses should review their capital structures and plan financial commitments more carefully during the initial setup.

Risks of High Registered Capital in China and Low Paid-in Capital —Case Study

1. Case Background

Suppose a Chinese foreign trade company has a Registered Capital of 10 million RMB, which may give the impression of financial strength. However, through a MANUAL COMPANY VERIFICATION REPORT or an INSTANT AUTOMATED COMPANY REPORT, it is discovered that five years after registration, the company’s Paid-in Capital remains ‘0’. Alternatively, the company may have reduced its Registered Capital from 10 million RMB to 1 million RMB, revealing a hidden issue. Although these changes may be legal, they present various risks for foreign businesses.

2. Potential Risks

Foreign businesses should verify the Registered and Paid-in Capital status of their partners before entering into any agreement. Through company reports, they can assess the capital situation and mitigate potential risks. Collaborating with a company that has high Registered Capital but low Paid-in Capital presents the following risks:

- Insufficient Funds: Despite the high Registered Capital, if the Paid-in Capital is 0, the company may lack sufficient funds to support its daily operations, which could affect its ability to fulfill contracts.

- Legal and Credit Risks: The company is required to convert Registered Capital into Paid-in Capital within five years. If it fails to comply, it may face legal penalties and damage its credit rating, making it difficult to secure future financing.

- Risk of Bankruptcy: A company with ‘0’ Paid-in Capital is more likely to collapse during financial distress. In this case, foreign partners could face challenges in recovering their money or goods.

3. Practical Suggestions

- Verify Paid-in Capital: Before entering into agreements, foreign companies should use a MANUAL COMPANY VERIFICATION REPORT or INSTANT AUTOMATED COMPANY REPORT to verify the Paid-in Capital. If the Paid-in Capital is 0 or significantly lower than the Registered Capital, it is wise to reconsider the cooperation.

- Diversify Risk: For companies with high Registered Capital but low Paid-in Capital, foreign businesses should consider using phased payments or secured contracts to minimize financial risk.

- Choose Companies with Adequate Paid-in Capital: It is generally safer to work with companies that have completed their Paid-in Capital contributions. These companies not only have stable financial foundations but also demonstrate the shareholders’ financial commitment.

Conclusion:

In conclusion, by clearly understanding the differences and significance of Registered Capital and Paid-in Capital in China, foreign businesses can better assess the actual strength and potential risks of their Chinese partners, leading to more informed and secure business decisions. Let multinational corporations’ business operations be more effective and efficient.