Contents

Introduction:

The Importance of China Registered Capital refers to the amount of capital that must be declared and committed by the shareholders or owners when forming a company in China. The process of establishing a business in China encompasses numerous details that need keen attention. Among them, registered capital is a key component that significantly impacts the formation and ongoing operations of a Wholly Foreign-Owned Enterprise (WFOE) in China. This deep dive will elucidate the complexities of registered capital and dissect its importance for a company’s success within China’s vibrant market economy. In this article, understanding the significance and importance of China Registered Capital in company formation is crucial for any entrepreneur looking to establish a business in China, as it dictates the minimum amount of money required to be legally recognized as a business entity.

Understanding Registered Capital in China

Registered capital refers to the funds that shareholders or company owners commit to invest in their business entity. According to Chinese laws, foreign individuals seeking to establish a WFOE must strictly observe the limited liability company framework. Unlike Chinese nationals, who can set up individual proprietorships, this is not an option for foreigners. Such an understanding of registered capital underscores a company’s financial robustness and capacity for sustained business ventures.

Legal Framework of China Registered Capital

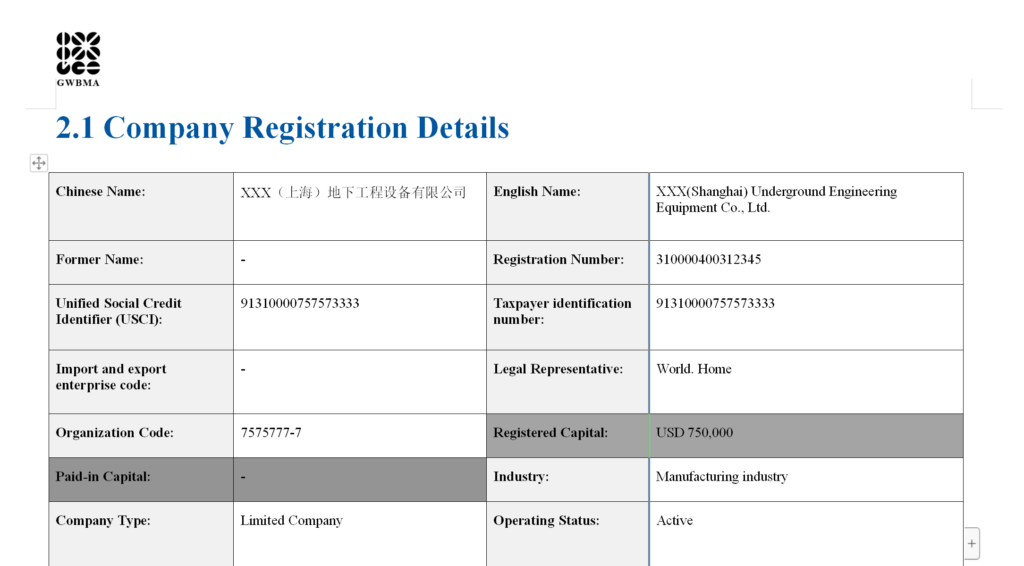

In China’s legal registry, nuances in registered capital are categorized as ‘Registered Capital‘ and ‘Paid-in Capital‘. These nuances become significantly important during the process of COMPANY VERIFICATION, which is essential for understanding the financial and legal status of Chinese companies on the mainland. A recent paradigm shift induced by the Subscription Capital System, overseen by the State Administration for Market Regulation (SAMR), eradicates previous limitations on the timeline for capital contributions. Now, shareholders are allowed the flexibility to transfer the requisite Registered Capital into the company’s foundational accounts over an extended period, potentially spanning decades.

The Importance of COMPANY VERIFICATION

Before delving deeper into the implications of registered capital, it’s paramount to understand the necessity of COMPANY VERIFICATION in China. This critical service, provided by specialized companies such as ours, enables foreign enterprises to verify and comprehend the financial and legal status of their Chinese business counterparts or potential investment targets. Our firm specializes in providing detailed reports that reveal the reality of a Chinese enterprise’s registered capital situation, the actual contributions made, and overall compliance, allowing foreign entities to make informed decisions.

Strategic Considerations of Registered Capital in China

Strategically, the amount of registered capital can be adjusted to align with business needs. Should it be deemed excessive, a company’s director, who usually acts as the legal representative, may approach SAMR with a petition to reduce the registered capital. For instance, a WFOE that initially declared a registered capital of $100,000 can lawfully decrease it to $10,000, even if no paid-in capital has been contributed thus far. This flexibility is a testament to the adaptability of China’s corporate regulatory system.

Implications for Business Operations

For newly established WFOEs, skating on the lower boundaries of registered capital might lead to unforeseen challenges. A nominal declared capital, say $1,000, could hamstring a business’s capacity to efficiently process visa or work and residence permits for its employees. It may also cast doubts on the company’s ability to fulfill its payroll obligations, thereby affecting the adjudication of Visa & Work and Residence Permits.

Conclusion:

More than just a financial figure, registered capital is instrumental in fortifying the operational groundwork of a WFOE in China. It affects the business’s credibility, regulatory compliance, and the actual ability to accommodate staff-related and operational expenditures. In the delicate dance of setting up a corporate presence in China, equipping the entity with an adequate amount of registered capital, as sanctioned by SAMR and evidenced through COMPANY VERIFICATION, ensures legal compliance and smooth business operations, thereby cushioning the path to commercial prosperity.