Contents

In the ever-evolving landscape of global business, establishing a foreign human resource certification in China stands as a strategic advantage for multinational companies. This detailed guide navigates through the necessary steps, legal requirements, and practical tips for successfully launching your China HR License or Certification program in the Chinese market. Understanding the nuances of China’s regulatory environment and leveraging them to your benefit can significantly enhance your company’s talent management strategy and operational efficiency.

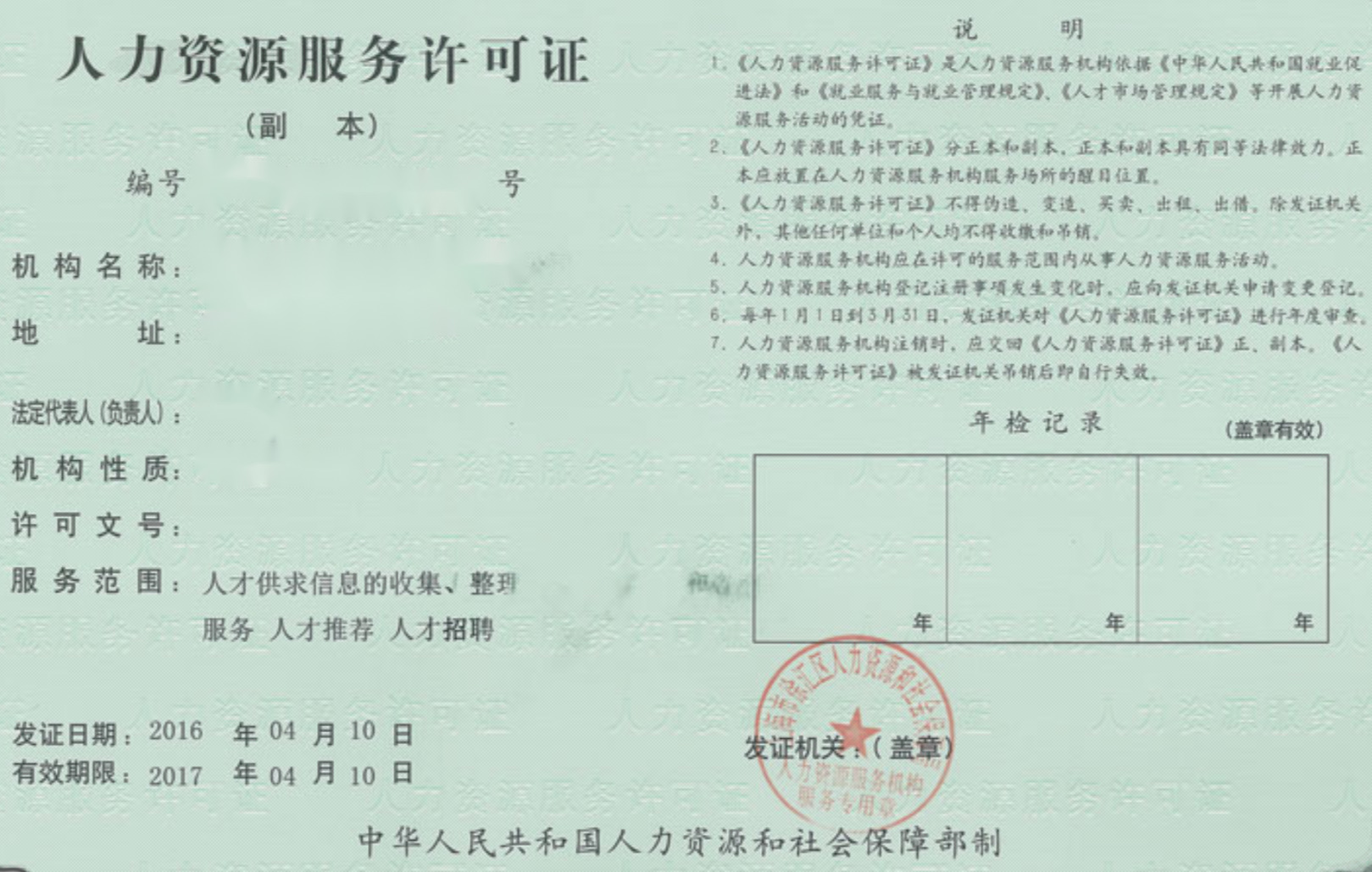

Regulatory Requirements for Establishing a Foreign China HR License

Initial Capital Investment of China HR

To fortify its commitment and ensure that a foreign HR firm has the requisite depth to handle potential risks, the Chinese regulatory framework mandates a minimum registered capital of RMB 500,000. This capital acts as a safety net, demonstrating the firm’s financial robustness and capability to sustain operations, even in fluctuating market conditions.

Legal Representation and Staff Qualifications

A fundamental requirement is that the legal representative and the primary officer must possess over three years of experience in labor and personnel work. Beyond this top-tier expertise, at least five professional staff members with associate degrees or higher and certification in HR market practices must be enlisted. Such stringent stipulations ensure that the firm not only understands the nuances of China’s HR landscape but also respects its professional and ethical standards.

Office and Operating Space of China Human Resource

Positioning the firm within a commercial locale is crucial, with a minimum office size of 50 square meters. This space requirement signifies the firm’s capacity to operate on a scale that justifies its foreign investment while providing adequate space for staff to perform their duties effectively. If the premises are leased, a minimum contract term of one year is mandatory, which fosters stability and ensures that the firm is perceived as a long-term player in the market.

Structural Integrity: Charters and Systems

The presence of a robust and feasible charter and systems, allied with the capability of independently bearing civil responsibilities, is non-negotiable. This indicates not only the firm’s readiness to integrate into the Chinese business fabric but also its preparedness to operate with a high degree of autonomy and accountability.

China HR Certification: Additional Legal and Regulatory Conditions

Adhering to additional legal and regulatory conditions as stipulated by the Chinese government further aligns foreign HR firms with local laws, ensuring smooth operations while minimizing legal exposure.

Revenue Generation in China HR License

China HR license: Traditional Intermediary Profits

Traditional recruitment practices serve as a primary revenue stream for HR companies. By matching job seekers with employers, these firms earn a service fee. Although the trend is now shifting towards not charging job seekers, the provision of executive search or headhunting services remains a lucrative aspect of the HR business.

China HR license: Outsourcing Profits

HR outsourcing has emerged as a sophisticated, large-scale, and structured profit model. Businesses outsource segments or entire HR processes to third-party HR firms for more specialized and efficient handling. These services extend across HR management, payroll, social security management, personnel outsourcing, and talent outsourcing, encompassing a broad revenue base.

As HR firms expand and diversify their offerings, these profit avenues will likely grow, reinforced by the increasing trend of companies looking for specialized external partners to manage their HR functions more effectively.

Conclusion

Setting up a foreign HR certification firm in China involves a meticulous process that requires a comprehensive understanding of local laws and business practices. Yet, the opportunities for such entities are sizeable, given the vast market and the rising demand for professional HR services. The pathway to establishing a foothold in China’s HR sector and operating a profitable enterprise is paved with regulation adherence, market acumen, and strategic service deployment.

Lastly, for those seeking expertise in the HR industry, our firm GWBMA stands ready to assist with navigating the complexities of market entry and operation. With our experienced team and deep knowledge of the Chinese HR market, we are ideally positioned to help foreign HR firms set up their certification services and capitalize on the potential of one of the world’s fastest-growing economies.